Proactive Defense: Bagley Risk Management Tips

Proactive Defense: Bagley Risk Management Tips

Blog Article

Exactly How Livestock Threat Defense (LRP) Insurance Coverage Can Protect Your Livestock Financial Investment

In the realm of livestock financial investments, mitigating dangers is critical to guaranteeing financial security and development. Livestock Risk Defense (LRP) insurance coverage stands as a trustworthy shield versus the unpredictable nature of the market, offering a critical method to securing your assets. By diving into the intricacies of LRP insurance policy and its multifaceted advantages, livestock producers can strengthen their financial investments with a layer of security that goes beyond market changes. As we explore the realm of LRP insurance coverage, its duty in securing livestock financial investments comes to be progressively noticeable, promising a path in the direction of sustainable monetary strength in a volatile market.

Comprehending Animals Danger Protection (LRP) Insurance Policy

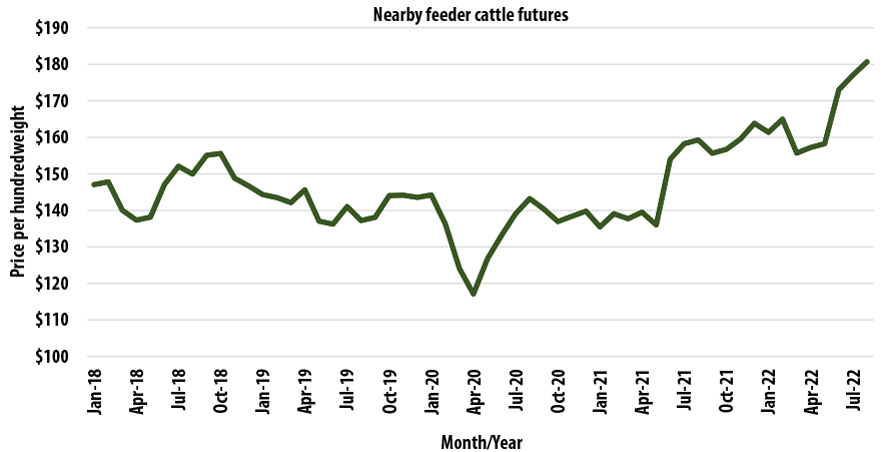

Comprehending Animals Danger Protection (LRP) Insurance policy is crucial for animals producers looking to minimize monetary risks connected with rate changes. LRP is a government subsidized insurance coverage product created to safeguard producers versus a drop in market rates. By supplying coverage for market rate declines, LRP aids producers secure in a flooring price for their animals, guaranteeing a minimal level of revenue no matter of market changes.

One trick element of LRP is its flexibility, enabling manufacturers to personalize protection degrees and plan lengths to match their certain demands. Manufacturers can select the number of head, weight array, protection price, and coverage period that straighten with their manufacturing objectives and take the chance of tolerance. Recognizing these customizable alternatives is crucial for manufacturers to successfully handle their cost threat exposure.

Moreover, LRP is available for numerous livestock types, including livestock, swine, and lamb, making it a flexible risk monitoring device for livestock manufacturers throughout various sectors. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make educated choices to secure their financial investments and make certain financial security in the face of market uncertainties

Benefits of LRP Insurance Coverage for Livestock Producers

Animals manufacturers leveraging Livestock Risk Defense (LRP) Insurance obtain a critical advantage in shielding their financial investments from rate volatility and safeguarding a secure economic ground in the middle of market uncertainties. By setting a floor on the price of their animals, manufacturers can minimize the threat of substantial economic losses in the occasion of market downturns.

Furthermore, LRP Insurance coverage gives manufacturers with peace of mind. Generally, the benefits of LRP Insurance coverage for animals manufacturers are considerable, using a useful device for taking care of risk and guaranteeing monetary safety in an unpredictable market atmosphere.

Just How LRP Insurance Policy Mitigates Market Threats

Alleviating market threats, Animals Threat Security (LRP) Insurance coverage provides animals manufacturers with a trusted guard against rate volatility and monetary unpredictabilities. By providing protection against unexpected price declines, LRP Insurance policy assists producers safeguard their investments and keep economic stability in the face of market fluctuations. This kind of insurance policy enables livestock producers to lock in a rate for their animals at the beginning of the plan duration, making sure a minimal price degree no matter market adjustments.

Steps to Safeguard Your Livestock Financial Investment With LRP

In the go to this site realm of agricultural threat management, applying Livestock Danger Defense (LRP) Insurance involves a calculated procedure to safeguard investments against market variations and uncertainties. To protect your animals financial investment efficiently with LRP, about his the initial step is to evaluate the details threats your procedure faces, such as cost volatility or unexpected weather condition events. Next off, it is critical to research and select a trustworthy insurance supplier that provides LRP plans tailored to your animals and company needs.

Long-Term Financial Safety With LRP Insurance

Making certain sustaining financial stability with the use of Livestock Risk Protection (LRP) Insurance coverage is a sensible lasting strategy for farming producers. By integrating LRP Insurance coverage into their danger monitoring plans, farmers can secure their animals investments versus unforeseen market fluctuations and negative occasions that could threaten their economic well-being over time.

One key advantage of LRP Insurance policy for lasting economic protection is the satisfaction More Bonuses it uses. With a reputable insurance coverage in position, farmers can alleviate the economic threats linked with unpredictable market conditions and unexpected losses due to variables such as illness break outs or all-natural catastrophes - Bagley Risk Management. This security allows producers to focus on the day-to-day operations of their animals company without consistent fret about potential monetary problems

In Addition, LRP Insurance coverage gives a structured technique to managing danger over the long-term. By setting certain coverage levels and picking appropriate endorsement durations, farmers can customize their insurance coverage intends to align with their monetary objectives and run the risk of resistance, making sure a sustainable and safe future for their livestock procedures. Finally, buying LRP Insurance coverage is a proactive approach for agricultural producers to achieve long lasting economic protection and safeguard their source of incomes.

Final Thought

In conclusion, Livestock Danger Defense (LRP) Insurance coverage is a valuable tool for livestock producers to reduce market threats and safeguard their financial investments. It is a wise selection for protecting animals investments.

.png)

Report this page